How Much Does Digital Nomad Insurance Cost? (2026 Pricing)

I’ll never forget the moment I realized I was paying way too much for my digital nomad insurance. After six months of shelling out $180 monthly for a policy I thought was reasonable, I discovered other nomads with nearly identical coverage were paying less than half that amount. The difference? They understood how insurance pricing actually works for remote workers.

Insurance costs for digital nomads vary wildly based on factors most people don’t consider when shopping for coverage. Age makes an enormous difference. So does whether you plan to visit the United States. Coverage limits, deductibles, and policy duration all impact your monthly premium in ways that aren’t immediately obvious.

After analyzing pricing across dozens of providers and speaking with insurance representatives, accountants, and hundreds of nomads about their actual costs, I’ve compiled this comprehensive breakdown of what you’ll really pay for digital nomad insurance in 2026. More importantly, I’ll show you how to calculate your personal insurance budget and identify opportunities to save money without sacrificing essential coverage.

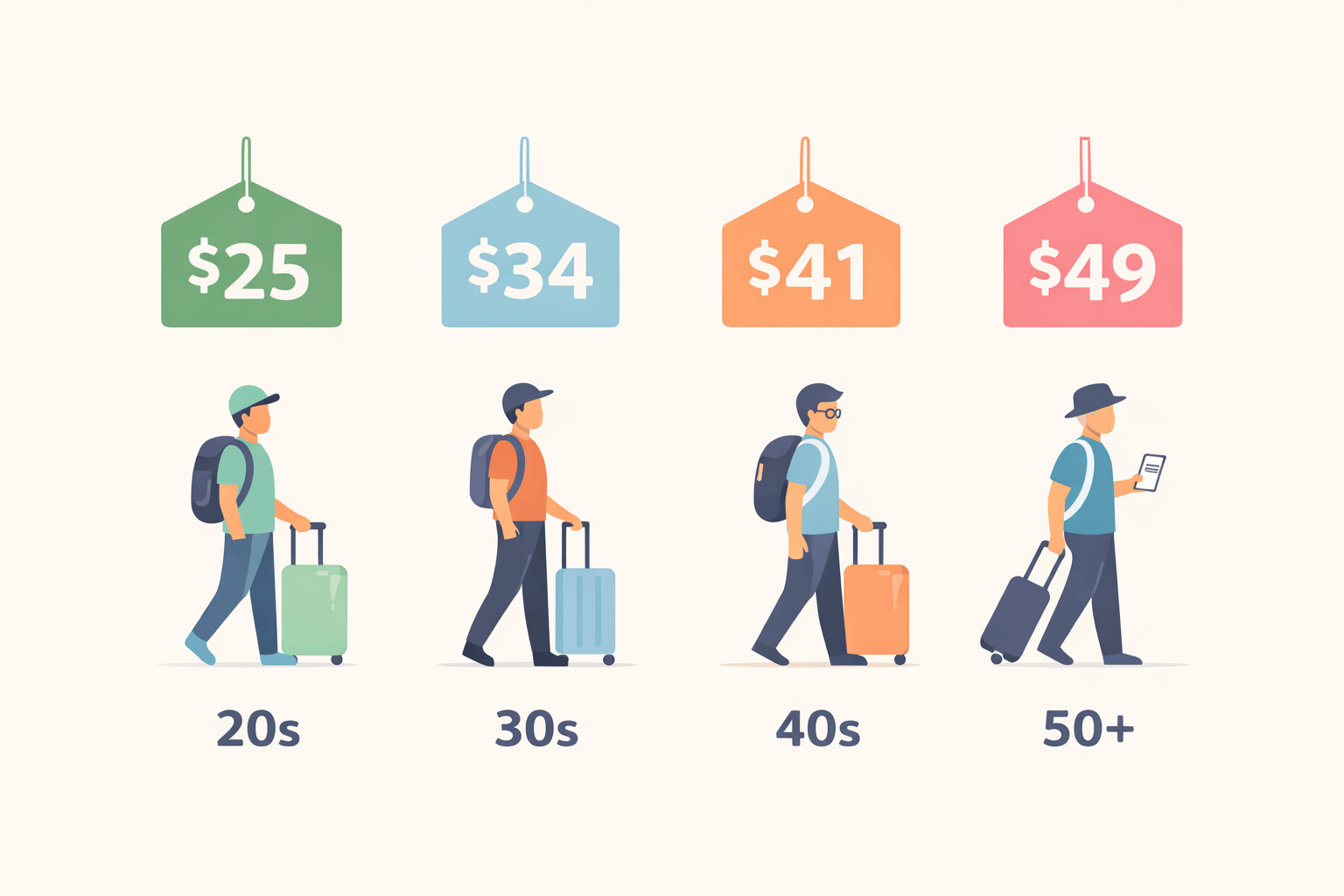

The real cost of digital nomad insurance by age

Age is the single biggest factor determining your insurance premium. Providers use actuarial tables showing older travelers statistically require more medical care, and they price policies accordingly.

Under 30 years old: Most healthy nomads in their twenties pay between $45 and $75 monthly for basic emergency coverage. SafetyWing charges $56 per month, Genki costs €39.90 (approximately $43), and IMG Global starts around $60. At this age, you’re getting the absolute best rates available.

Ages 30-39: Premiums increase slightly but remain affordable, typically ranging from $56 to $95 monthly. SafetyWing maintains its $56 rate through age 39, while World Nomads and IMG begin charging 15-25% more than they charge twenty-somethings. If you’re 35, expect to pay around $70-80 for standard emergency coverage.

Ages 40-49: This is where costs jump significantly. Most providers increase premiums by 40-60% compared to under-40 pricing. SafetyWing charges approximately $140 monthly for 40-49 year-olds, nearly triple the under-40 rate. World Nomads pricing reaches $150-200 monthly depending on nationality and destinations. Comprehensive plans from Cigna Global start around $250-300.

Ages 50-59: Premiums continue climbing steeply. Emergency-only coverage from SafetyWing costs $180-220 monthly, while comprehensive international health insurance from Cigna or Allianz easily exceeds $400 monthly. Many providers cap coverage at age 69 or require medical underwriting after 60.

Ages 60+: Insurance becomes expensive and harder to find. SafetyWing charges $280+ monthly for travelers over 60, and many adventure-focused policies exclude this age group entirely. Comprehensive coverage from major international insurers ranges from $500 to $800 monthly, with some plans exceeding $1,000 for travelers over 70.

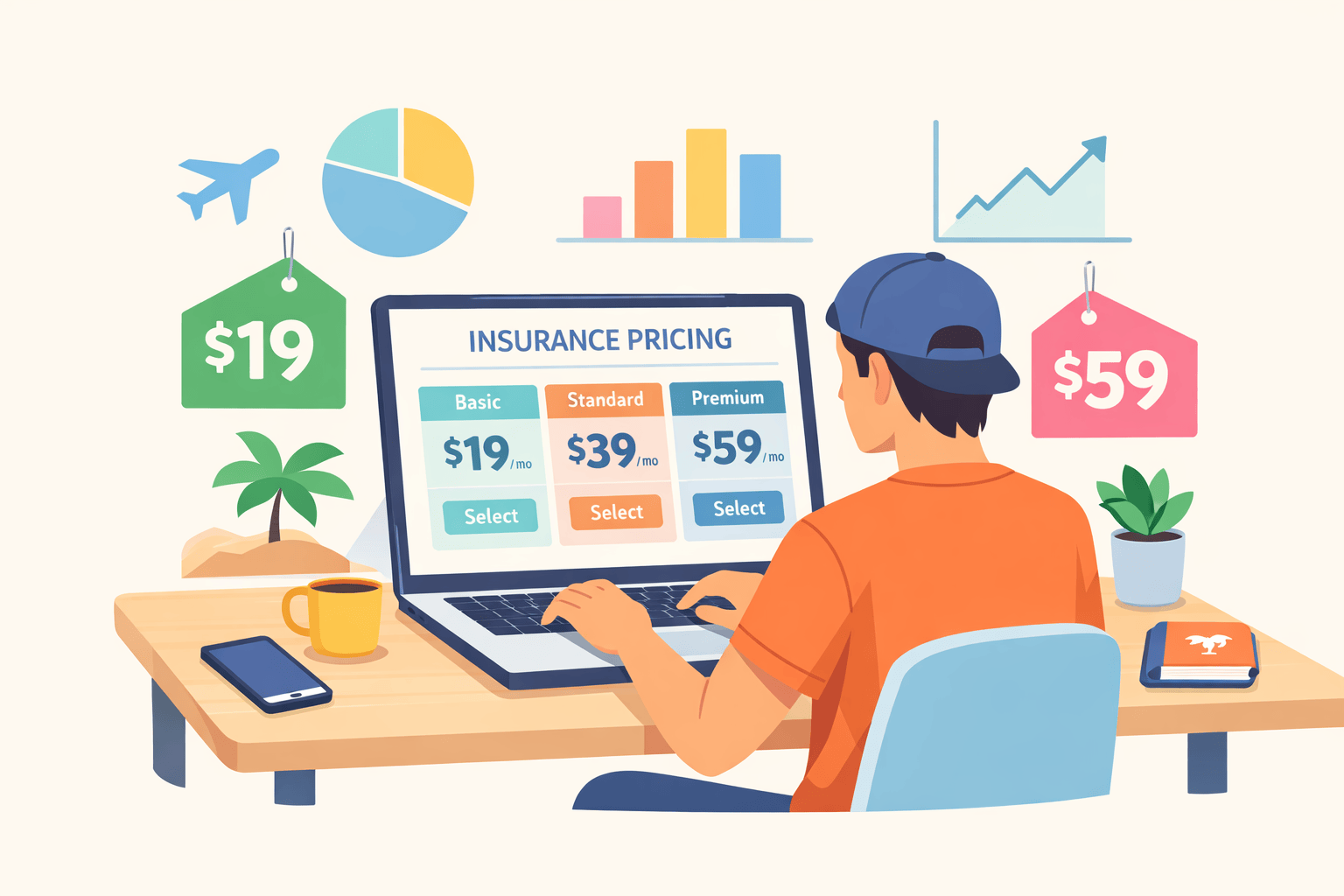

Coverage level dramatically impacts pricing

Beyond age, the amount of coverage you purchase directly determines your premium. Most providers offer multiple tiers with vastly different price points.

Basic emergency coverage ($50,000-100,000 limit): This represents the minimum viable protection for digital nomads. Plans in this category cost $45-80 monthly for travelers under 40. They cover emergency room visits, hospitalization, surgery, and medical evacuation, but exclude routine care, prescriptions, and most outpatient treatment. This works fine if you’re healthy and primarily need protection against catastrophic expenses.

Standard coverage ($250,000-500,000 limit): Most digital nomads choose this middle tier, paying $56-120 monthly depending on age. SafetyWing’s $250,000 coverage limit falls here. This provides adequate protection for most medical emergencies in countries with reasonable healthcare costs, though it could prove insufficient for extended hospitalization in expensive countries like the United States or Switzerland.

Premium coverage ($1,000,000+ limit): High-limit policies cost $200-400 monthly but provide peace of mind for serious medical situations. Genki offers €1 million coverage at €39.90 monthly for under-35s, making it exceptional value. IMG Global’s platinum plans with unlimited coverage start around $300 monthly.

Comprehensive health insurance (unlimited): True international health insurance with unlimited coverage, routine care, prescriptions, dental, and mental health services costs $250-800 monthly depending on age and specific benefits. Cigna Global, Allianz Care, and Aetna International dominate this category. These plans make sense for families, older nomads, or anyone with chronic conditions.

The USA coverage premium

Here’s something most nomads don’t realize until they start comparing quotes: including the United States in your coverage area increases premiums by 40-80%.

American healthcare costs are so extraordinarily high that insurers charge massive premiums to cover U.S. medical treatment. A broken arm that costs $800 to treat in Portugal or $1,200 in Germany runs $7,500-15,000 in the United States. Appendicitis surgery costing $3,000 in Thailand costs $35,000-50,000 in America.

Because of this pricing reality, many providers either exclude the United States entirely or offer separate pricing tiers. Genki doesn’t cover the U.S. at all, keeping costs low. SafetyWing includes limited U.S. coverage in their standard price but only for visits home of less than 30 days per 90-day period.

If you’re an American nomad who regularly visits home, you’ll pay significantly more than European or Asian nomads who never travel to the United States. Budget an extra $30-80 monthly if you need full U.S. coverage.

Deductibles and their impact on monthly costs

Deductibles represent the amount you pay out-of-pocket before insurance coverage kicks in. Higher deductibles lower monthly premiums but increase your immediate costs during medical situations.

Zero deductible: Genki offers zero-deductible coverage at €39.90 monthly. You pay nothing upfront when receiving medical care (after which the insurance covers eligible expenses). This is ideal for nomads who want predictable costs and may need care for minor issues.

$250 deductible: SafetyWing’s $250 deductible per incident is standard in this category. For a $1,000 emergency room visit, you’d pay $250 and insurance covers the remaining $750. This keeps monthly premiums affordable while still protecting against major expenses.

$500-1,000 deductible: Many IMG and World Nomads plans offer these higher deductibles in exchange for lower monthly premiums. You might save $20-40 monthly but will pay significantly more if you actually need medical care.

$2,500+ deductible: Some catastrophic coverage plans feature very high deductibles that essentially protect only against hospitalization and major surgery. Monthly costs drop to $30-50, but you’re paying everything out-of-pocket unless you face a serious medical situation costing thousands of dollars.

The right deductible depends on your risk tolerance and savings. If you have $5,000 set aside for emergencies, a $1,000 deductible might make sense. If you’re running lean financially, paying slightly more monthly for a lower deductible provides better protection.

Annual vs monthly payment options

Most digital nomad insurance operates on monthly billing, but annual payment options can save 10-15% on total costs.

SafetyWing charges $56 monthly ($672 annually) but doesn’t offer annual discounts since their model is built around flexible month-to-month coverage. World Nomads typically discounts annual policies by 10%, so instead of paying $100 monthly ($1,200 annually), you’d pay around $1,080 upfront for the year.

The tradeoff is flexibility. Paying monthly lets you cancel or pause coverage if you return home or change plans. Annual payment commits you for twelve months, which works well if you’re certain about your travel plans but creates complications if circumstances change.

For established digital nomads with predictable travel patterns, annual payment saves money. For newer nomads still figuring out the lifestyle, monthly billing provides valuable flexibility worth the slight premium.

Calculating your personal insurance budget

Here’s a practical framework for estimating your monthly insurance costs based on your specific situation:

Step 1 – Start with your age bracket:

- Under 30: Base cost $50

- 30-39: Base cost $65

- 40-49: Base cost $140

- 50-59: Base cost $200

- 60+: Base cost $300

Step 2 – Adjust for coverage level:

- Basic ($50-100K): No adjustment

- Standard ($250-500K): Add $10

- Premium ($1M+): Add $30

- Comprehensive unlimited: Add $150

Step 3 – USA coverage adjustment:

- Regular U.S. visits: Add $40

- Occasional U.S. visits: Add $20

- No U.S. coverage needed: No adjustment

Step 4 – Deductible adjustment:

- Zero deductible: Add $15

- $250 deductible: No adjustment

- $500+ deductible: Subtract $20

Step 5 – Special considerations:

- Adventure sports coverage: Add $30

- Pre-existing condition coverage: Add $50-100

- Family coverage (spouse/children): Add $40-80 per person

Using this framework, a 35-year-old nomad wanting standard coverage with occasional U.S. visits and a $250 deductible would budget approximately $95 monthly ($65 + $10 + $20 = $95). This aligns closely with actual market pricing from providers like World Nomads and IMG Global.

A 28-year-old European nomad who never visits the United States could budget just $50 monthly, matching Genki’s pricing almost exactly.

Hidden costs nobody mentions

Beyond your monthly premium, several additional costs affect your total insurance spending:

Out-of-pocket medical expenses: Even with insurance, you’ll pay deductibles, co-pays, and costs for uncovered services. Budget an additional $200-500 annually for these expenses.

Reimbursement delays: Many policies require you to pay upfront and submit claims for reimbursement. You’ll need accessible savings to cover initial costs, which can take 2-6 weeks to be reimbursed.

Currency conversion fees: If you’re paying in euros while earning dollars (or vice versa), exchange rates and conversion fees add 2-4% to your effective costs.

Coverage gaps: Switching between providers or letting coverage lapse creates uninsured periods. If something happens during a gap, you’re completely exposed. Some nomads maintain overlapping coverage for a month when switching providers, effectively doubling costs briefly.

Exclusions and claim denials: Not every medical expense gets covered. Pre-existing conditions, risky activities without proper riders, and routine care on emergency-only policies all generate denied claims that you’ll pay out-of-pocket.

Real-world examples from digital nomads

To illustrate how these costs play out practically, here are five real nomads and their actual 2026 insurance expenses:

Sarah, 29, U.S. citizen, Southeast Asia: Uses SafetyWing at $56 monthly ($672 annually). Had one minor medical claim in Vietnam for a sinus infection that cost $85 total, with $250 deductible meaning she paid everything out-of-pocket. Total annual cost: $757.

Marcus, 42, German, Europe/Latin America: Uses Genki at €39.90 ($43) monthly but ages out at 40, so now pays SafetyWing $140 monthly for 40-49 age bracket ($1,680 annually). No claims this year. Total annual cost: $1,680.

Yuki, 35, Japanese, worldwide travel including U.S.: Uses World Nomads at $125 monthly ($1,500 annually). Filed claim for emergency dental work in Mexico costing $650, received $400 reimbursement after deductible. Total annual cost: $1,750.

Tom and Lisa, both 38, married with one child (age 6): Use Cigna Global family plan at $520 monthly ($6,240 annually). Comprehensive coverage includes routine care, prescriptions, and dental. Lisa had prenatal checkups covered, son had two regular checkups. Total annual cost including co-pays: $6,500.

David, 55, Australian, Asia/Europe: Uses IMG Global at $210 monthly ($2,520 annually). Had hospitalization in Thailand for kidney stones costing $4,200 total, paid $500 deductible, insurance covered remaining $3,700. Total annual cost: $3,020.

These examples show how actual costs include both premiums and out-of-pocket expenses. Even the best insurance doesn’t eliminate all medical spending.

Smart ways to reduce insurance costs

After years of optimizing my own insurance spending, I’ve identified several strategies that meaningfully reduce costs without sacrificing essential coverage:

Choose zero-U.S. coverage if possible: If you’re not American and don’t plan U.S. visits, choosing providers like Genki that exclude the United States saves $30-50 monthly compared to worldwide coverage.

Accept higher deductibles: If you have $2,000+ in emergency savings, choosing a $500 or $1,000 deductible instead of $250 reduces premiums by $20-40 monthly. Over a year, that’s $240-480 in savings that exceeds the increased deductible cost unless you have multiple medical issues.

Skip adventure riders if you don’t need them: World Nomads charges premium prices partly because they cover activities like scuba diving and rock climbing. If you’re not doing these activities, choose cheaper providers focused on basic emergency care.

Time your birthday: Insurance age brackets typically change on your birthday. If you’re turning 40 soon and premiums will double, consider purchasing annual coverage before your birthday to lock in lower rates for twelve months.

Use local healthcare for minor issues: In countries with affordable healthcare like Thailand, Portugal, or Mexico, paying $30-80 out-of-pocket for a doctor visit makes more sense than filing a claim that won’t exceed your deductible anyway. Save insurance for genuine emergencies.

Maintain continuous coverage: Letting coverage lapse often eliminates your ability to re-enroll without waiting periods or medical underwriting. Continuous coverage is cheaper long-term than starting and stopping policies.

What you should actually budget

For financial planning purposes, here are realistic annual insurance budgets for different nomad profiles:

- Young healthy nomad (under 30): $600-900 annually

- Mid-career nomad (30-40): $800-1,400 annually

- Established nomad (40-50): $1,700-2,500 annually

- Senior nomad (50+): $2,500-6,000 annually

- Family of three: $4,000-8,000 annually

These figures include premiums plus reasonable out-of-pocket expenses for minor medical care and deductibles.

Remember that insurance represents a small fraction of your total nomad budget. If you’re spending $2,000-3,000 monthly on accommodation, food, transportation, and other living costs, adding $50-150 for insurance barely impacts your overall budget while providing crucial financial protection.

The expensive mistake isn’t spending too much on insurance. It’s spending too little and facing catastrophic medical bills that drain your savings or force you to return home and abandon the nomadic lifestyle entirely.

Understanding these costs helps you budget appropriately and choose coverage that matches your needs without overpaying. If you’re wondering exactly which insurance requirements apply to your specific destination countries, explore our detailed breakdown of digital nomad visa insurance requirements by country where we cover minimum coverage amounts and accepted providers for popular nomad destinations worldwide.